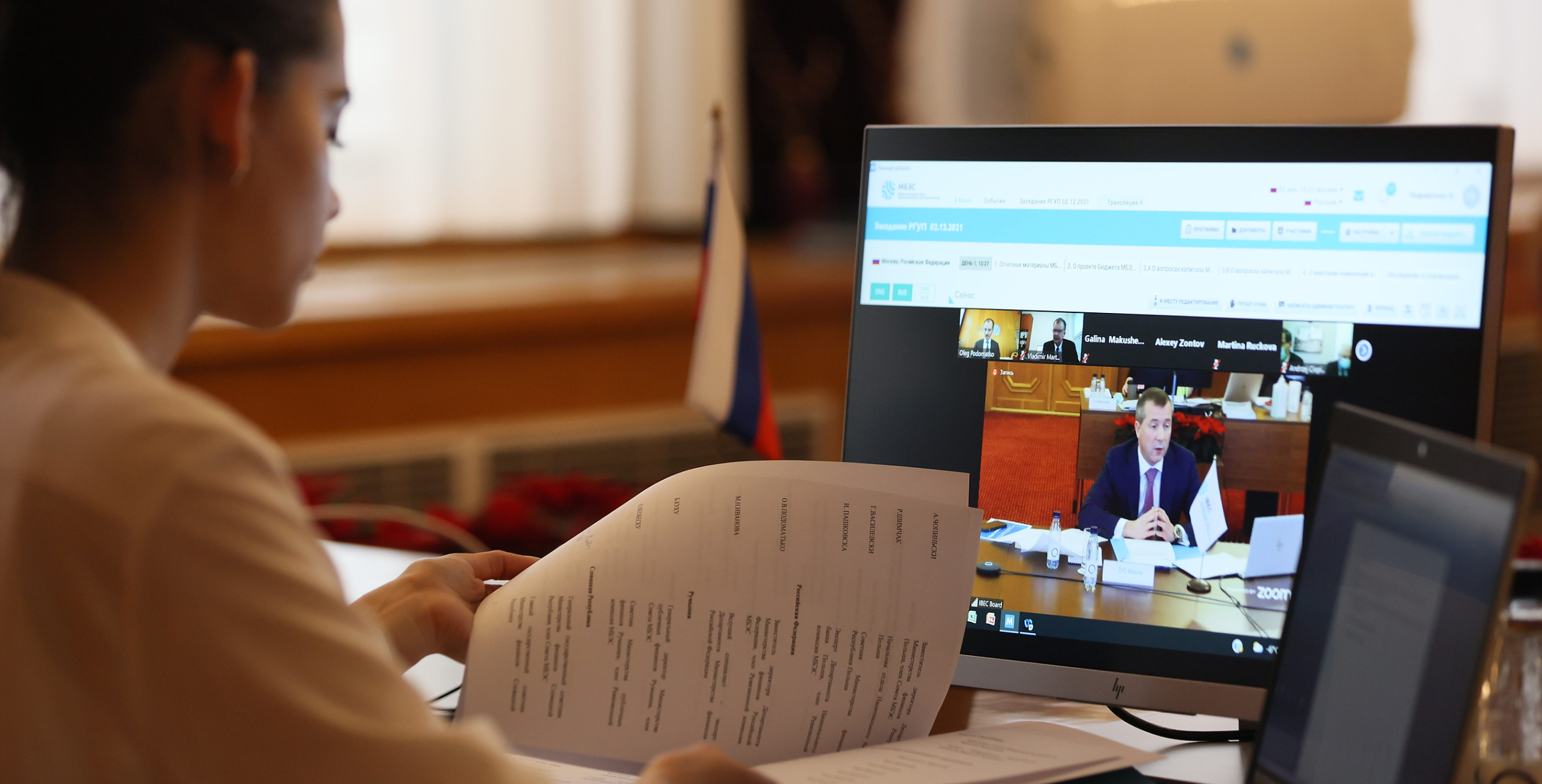

On December 3, 2021 a regular 137th meeting of the Council of the International Bank for Economic Co-operation took place. Like the previous several meetings of the Council, due to the ongoing pandemic situation, the meeting was held in the format of a videoconference.

In his opening remarks, the Chairman of the Board, Denis Ivanov, informed the shareholder delegations about the progress in implementing the new development strategy of IBEC, noting, in particular, about two important milestones for the Bank. For the first time in the Bank’s history, the loan portfolio exceeded half a billion euros, having reached EUR 504 million by November, 2021, and the total amount of IBEC investments in the economies of the member countries (in the form of short-term and long-term loans, letters of credit and guarantees) reached EUR 1 billion. The Chairman of the Board also turned the spotlight on the Bank’s key performance indicators, mentioning that IBEC total assets increased to EUR 796.2 million, showing an increase of 22% compared to the beginning of 2020, and the growth of the loan and documentary portfolio amounted to more than 20%, exceeding the targets set in strategy.

According to Denis Ivanov, “this year has proved that the chosen vector of development ensures the efficient operation of the Bank even against the background of the restrictions caused by the pandemic. IBEC is constantly implementing new projects and operations aimed at supporting the Sustainable Development Goals and economic growth of its member states".

At the same time, IBEC pays more and more attention to projects and operations related to the "green economy" and support for small and medium-sized businesses, supports the development of social infrastructure, medicine and pharmaceuticals, scientific and high-tech developments.

The progressive development of the banking business is more and more reflected in the external environment. Leading rating agencies have revised the credit ratings of IBEC. In March, Fitch Ratings upgraded its credit rating to BBB with a stable outlook, and in September, Moody’s changed its outlook on the Bank's rating from “Stable” to “Positive”.

In 2021, the Bank's achievements were noted with international awards – British media portal Global Banking & Finance Review awarded IBEC in the nomination "Best Trade Finance Bank Eastern Europe 2021" and Chairman of the Board Denis Ivanov as "Banking CEO of the Year Eastern Europe 2021".

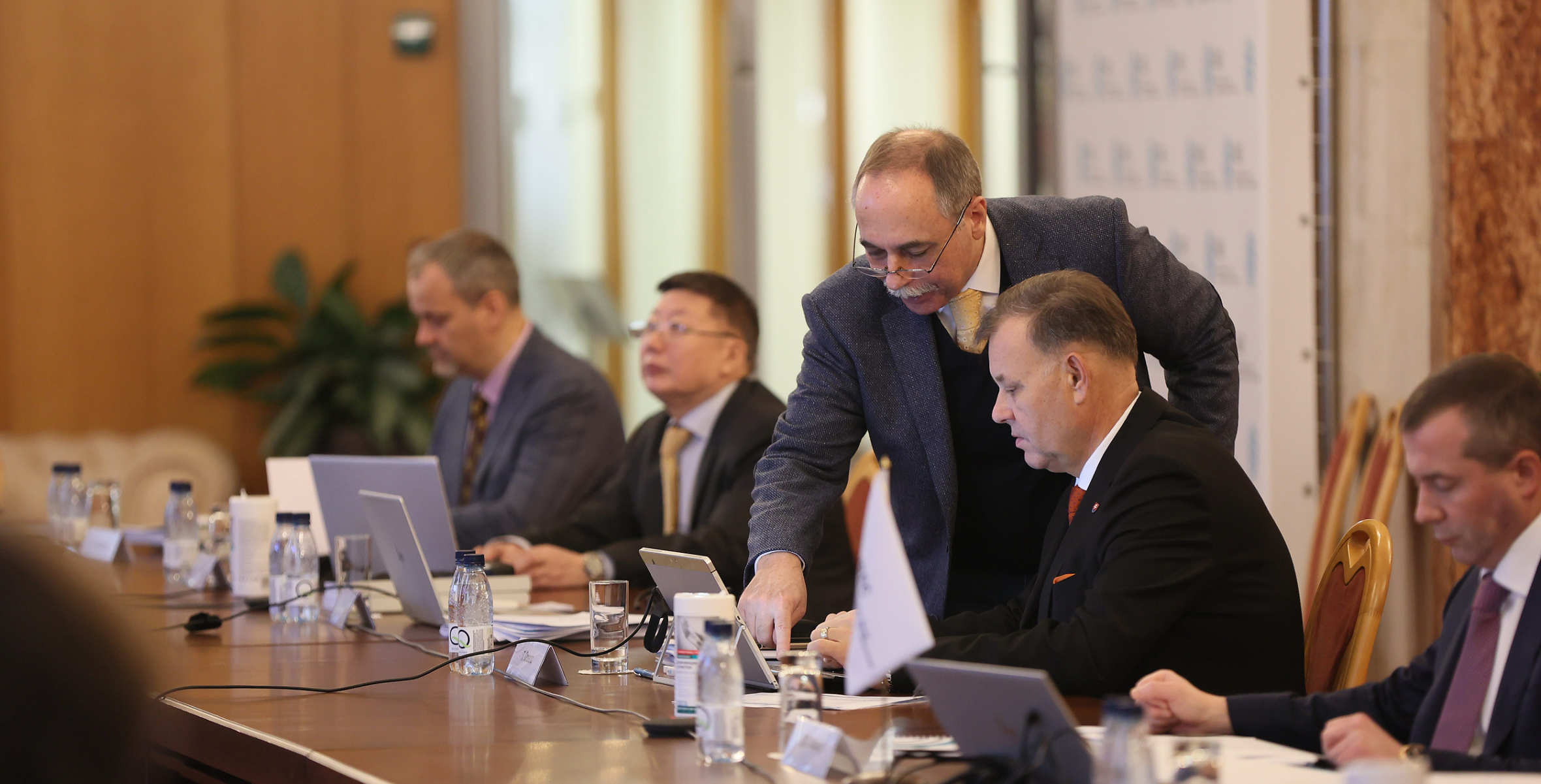

The delegations of the member countries in their speeches noted the impressive success of the Bank, expressed their support for the efforts of the IBEC team and, in general, for the active development of the Bank's operations for the benefit of all its shareholders. The Council reviewed the results of IBEC activities in the first half of 2021, including the report of the Board on the results of the first half of the year and budget execution.

An important milestone in the Bank's institutional development was the Council's approval of the 2022 budget, which for the first time included key performance indicators and their targets for 2022.

Also, during the meeting, the delegations approved an updated version of the Regulation on social guarantees for IBEC employees, which provided for updating the conditions for attracting employees who are not citizens of the host country, in order to improve the IBEC brand as an employer, as well as maintain and develop the international character of the Bank's staff.

The Council decided to hold the next 138th meeting in the first half of 2022 in St. Petersburg and approved its provisional agenda.

Ru

Ru Bằng tiếng việt

Bằng tiếng việt

Mongoloor

Mongoloor

765X478.jpeg)

.jpg)

.jpg)

.jpg)