Analytical Credit Rating Agency (ACRA) affirms 'BBB+' to International Bank for Economic Co-operation, Outlook Stable, under the international scale, 'AAA(RU)', Outlook Stable, under the national scale for the Russian Federation and 'AAA(RU)' to IBEC bond issue 001R-02 (RU000A101RJ7).

In the official press release, ACRA emphasizes that the amount of the Bank's assets and contingent liabilities increased in 2023, and the financial result returned to positive values. Thus, we can already say that the significant loss recorded at the end of 2022 was of a one-off nature and will not impact the Bank's ability to deliver positive financial results in the future.

The Bank's assets grew mainly due to interbank trade finance loans and investments in debt securities. At the same time, the quality of assets remains quite high, and the share of debt overdue for more than 90 days remains at a low level. The Agency also notes still high capital adequacy, amounting to 53% as of the end of 2023, which allows the Bank to withstand potential risks of significant deterioration of asset quality.

The overall diversification of liabilities remains moderate, and funds raised from other banks amounted to less than 20% of all liabilities at the end of 2023. The amount of highly liquid assets noticeably exceeds the amount of short-term liabilities, which indicates the preservation of strong liquidity indicators.

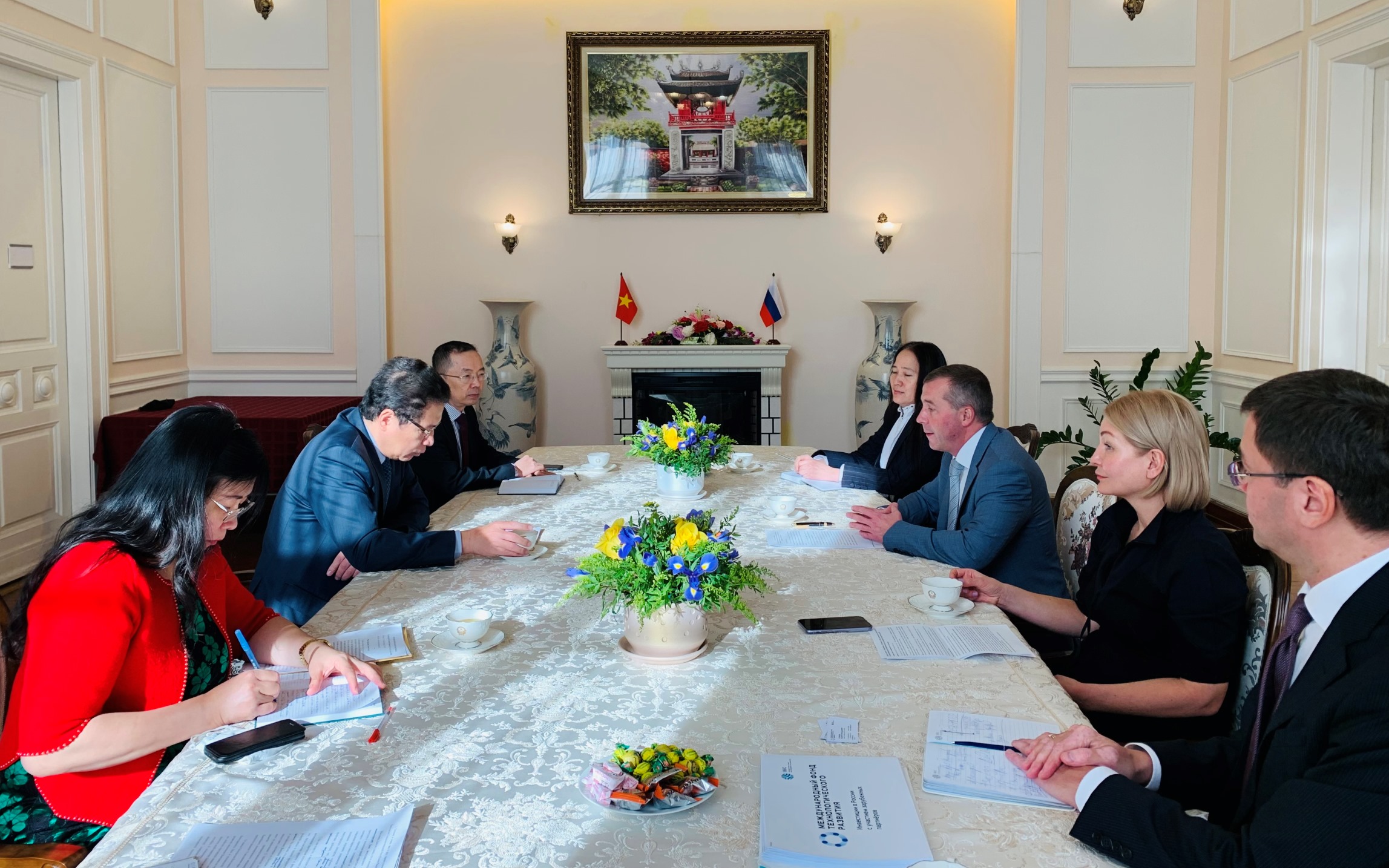

In the current circumstances, IBEC maintains the focus on promoting the development of economies and foreign trade relations of the member countries and pays special attention to geographical diversification of its activities by entering new markets. The new strategy currently being developed will allow the Bank to define strategic priorities and specify its business model in the medium term.

Ru

Ru Bằng tiếng việt

Bằng tiếng việt

Mongoloor

Mongoloor

765X478.jpeg)

.jpg)

.jpg)

.jpg)