In the official rating report CCXI affirms the advantages of International Bank for Economic Co-operation, including the very high strategic status, very strong willingness to support from major member states, clear strategic positioning, relatively strong capital strength indicators, prudential liquidity management, and very high coverage of current assets to short-term liabilities, all of which effectively underpin the overall credit status of the Bank.

CCXI believes that IBEC accomplished its previous strategic goals well and has established a sound risk management system. At the policy level, the Bank has implemented a four-level structure for risk management. Such system ensures the Bank’s sustainable operations despite fluctuations in the overall business environment. Additionally, the Bank maintains a prudent risk appetite and is capable of effectively meeting the internally set risk management indicators. The Bank maintains a very low NPL ratio, which stood at just 0.3% as of the end of 2023.

In the view of CCXI, the coverage ratio of Bank’s usable equity on risk weighted assets is very high, and the gross debts/usable equity is at a very low level. Overall, the Bank's capital strength indicators show relatively strong performance.

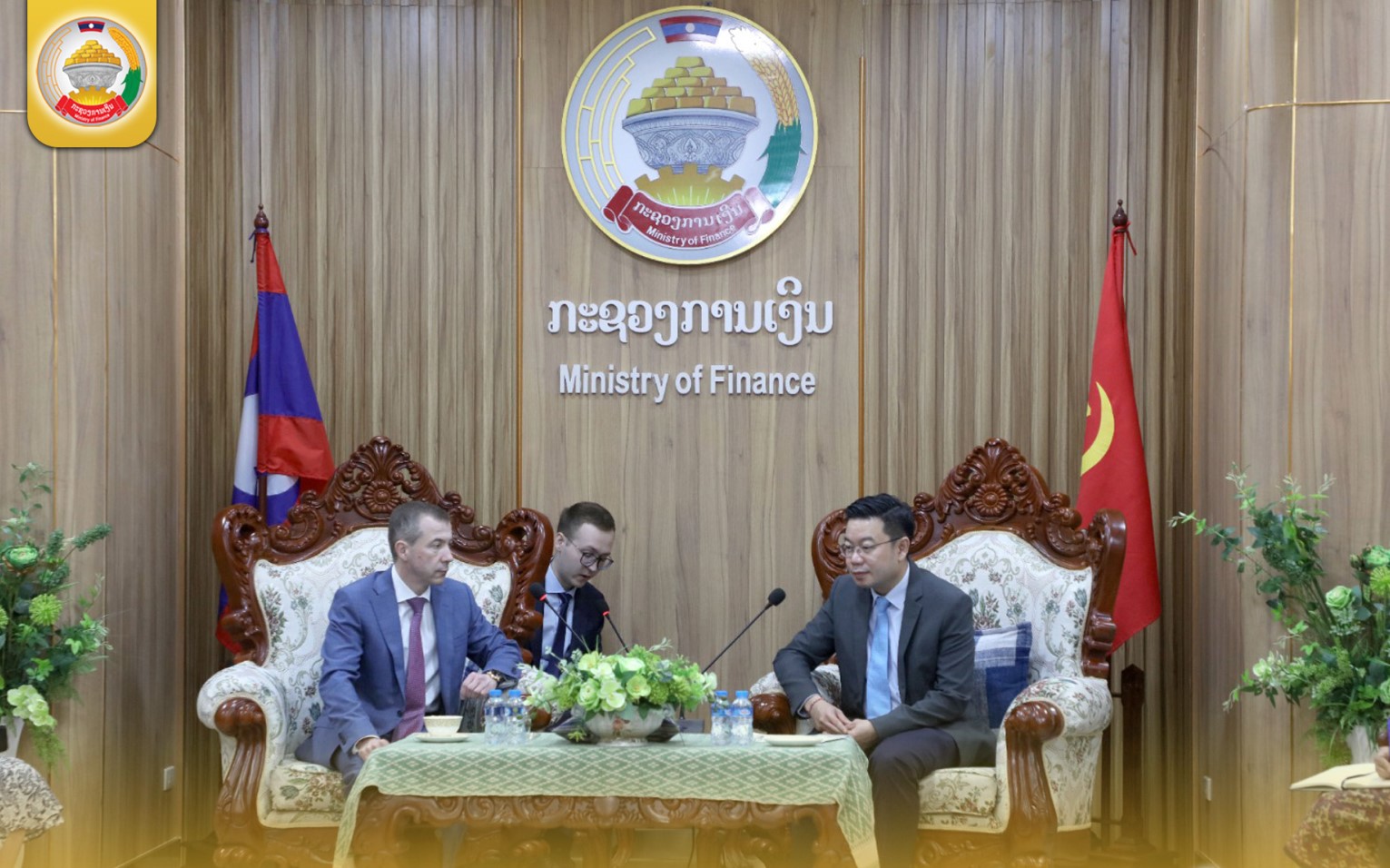

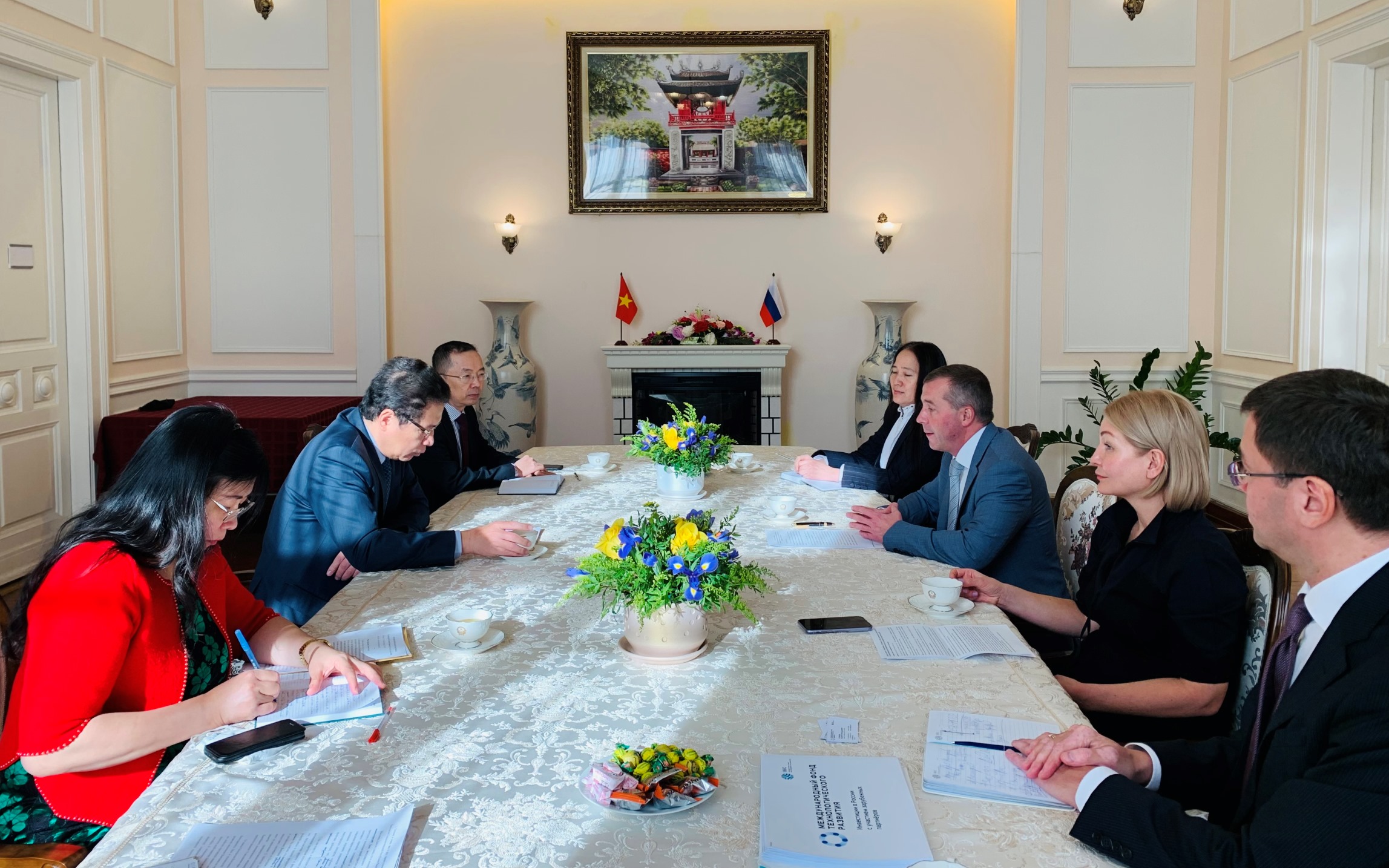

CCXI highlights the IBEC conducts prudential liquidity management, and its current assets can fully cover its short-term debts. The Bank is actively expanding its financing channels to enhance flexibility and cost effectiveness in fund raising, including more effectively utilizing the domestic capital market for financing, examining member states and potential markets to identify new funding sources, and exploring CNY financing. These efforts are expected to broaden the Bank’s financing channels in the future.

IBEC supports the import and export trade operations of its member states through various instruments such as trade finance, direct financing, debt investments, and guarantees, which is closely aligned with its strategic objective of promoting trade development among its member states. Obtaining the Chinese onshore rating reflects the Bank’s commitment to expand its presence in the Asian region.

IBEC has the following credit ratings:

• ‘ААА’ from CCXI with a stable outlook (04/07/2024)

• ‘ААА(RU)’/‘ВВВ+’ from ACRA with a stable outlook (19/02/2024)

Ru

Ru Bằng tiếng việt

Bằng tiếng việt

Mongoloor

Mongoloor

765X478.jpeg)

.jpg)

.jpg)

.jpg)