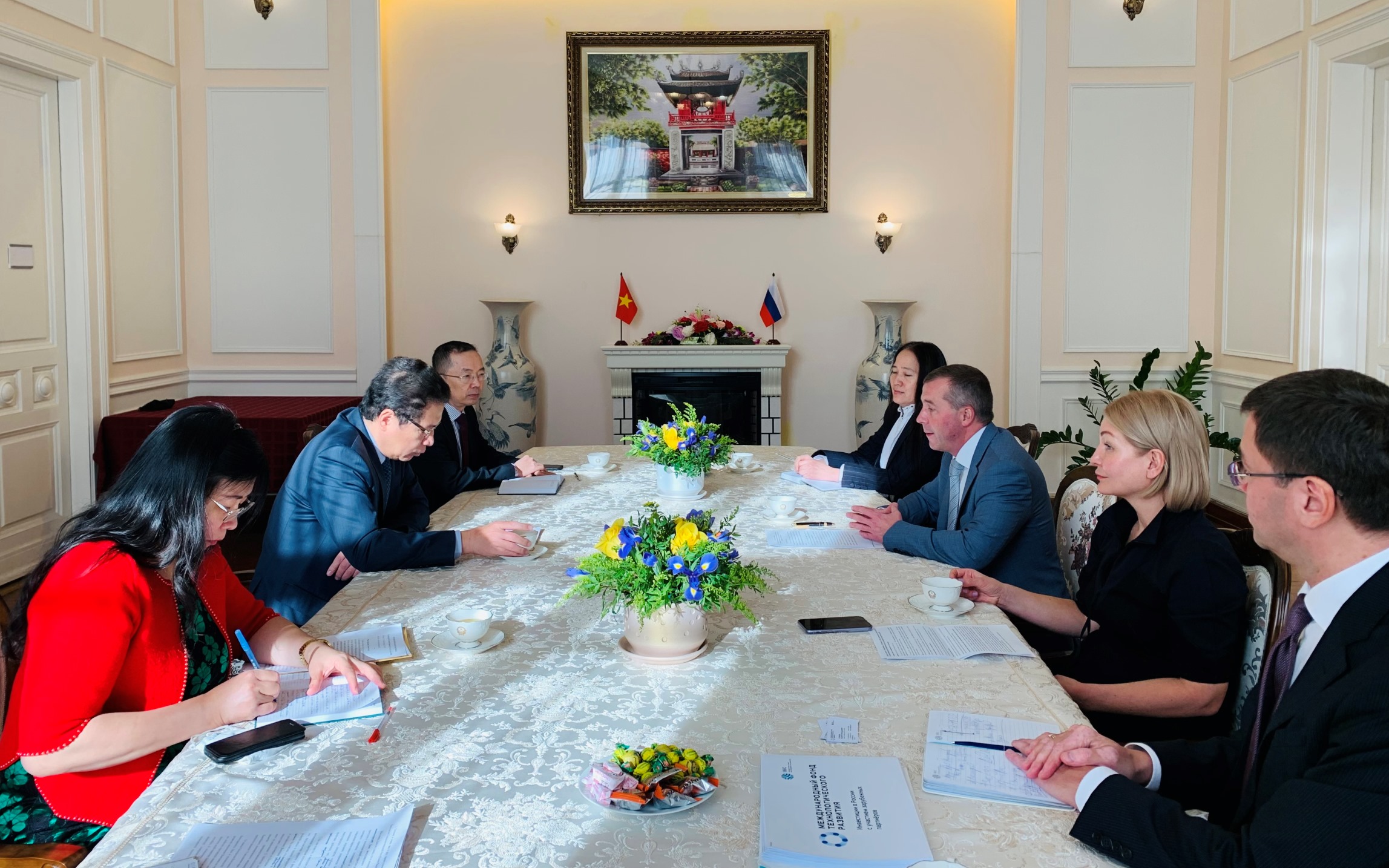

Changes in the work of the vast majority of companies and institutions are becoming more persistent and long-lasting. In the face of continuing uncertainty on the timing of the final overcome of the pandemic, the business community begins a dialogue on a new format of cooperation, new models and standards of business communications. Financial & Business Association of Euro-Asian Cooperationheld a videoconference "Credit institutions activities in times of pandemic." Among the topics discussed are: transformation of customer service models and processes, problems of information exchange with regulators, trade finance special features during quarantine. The conference was attended by representatives of banking organizations from 11 states. The discussion was moderated by Alexander Murychev, Chairman of the Board of the FBA.

The Chairman of the Board of the International Bank for Economic Co-operation Denis Ivanov made a keynote speech. Presenting to the participants his experience in organizing work under conditions caused by the pandemic, the head of IBEC outlined new challenges for development institutions and the Bank's strategy in the changing conditions of global uncertainty.

IBEC ensured coordinated efforts in times of crisis, promptly implementing the primary measures to switch to new formats of work, ensuring safety and protecting the health of its employees. The transition to a predominantly remote mode of operation had already been carried out in mid-March. This transition required an extraordinary upgrade of technological equipment and especially effective work of the IT department. As noted by Mr. Ivanov, the modernization of IT infrastructure has led to an unplanned, but promising breakthrough in the technological modernization of the Bank. And this is one of the positive effects of the current crisis.

As a result, the Bank continues to provide services for customers and partners without any interruptions. This is especially important in the context of the IBEC's mandate of supporting international trade and foreign economic relations of the member states. The active development of the trade finance portfolio products over the past year and a half allows IBEC to offer effective solutions that are in demand by the market. During the remote work, IBEC provided more than 20 loans to ensure export-import operations - transactions were implemented through the banks of member states and other partner states. The Bank financed the supply of consumer goods to Belarus from Poland, Russia, the Czech Republic, Bulgaria, food products to Vietnam, the export of Russian food and chemical products to Belarus, as well as the goods of the Belarusian glass and food industry to Russia, the supply of Polish chemicals to Belarus, and the supply of consumer electronics to Mongolia from Singapore, Hong Kong, Kazakhstan, China, the EU. Despite the high volatility in the financial markets, loan terms reach 12 months, which was made possible due to the stable resource base of IBEC. Competent policy in the treasury operations market and professional risk management made it possible to avoid the negative impacts of the volatility, which prevails in the markets, on the treasury portfolio and on the state of the Bank's assets. In general, the updated IBEC business model withstands the test in an unprecedented international crisis.

According to Denis Ivanov, the crisis inevitably affects the shape of the medium-term development strategy of IBEC as a multilateral development bank. Against the background of a likely change in the global economic environment and the priorities of the member states, it is essential to address responsibly such issues as overcoming inequality, protecting human health, protecting biodiversity and ecosystems, and combating climate change. For development institutions, and for IBEC, in particular, these tasks become priorities, along with creating an effective architecture for sustainable development, rational resource management, and strengthening international cooperation.

After the presentation, participants of the conference hold constructive discussion of the topics raised, going beyond financial and commercial issues, and addressing the prospects of post-pandemic development of the international economy and the financial sector.

Ru

Ru Bằng tiếng việt

Bằng tiếng việt

Mongoloor

Mongoloor

765X478.jpeg)

.jpg)

.jpg)

.jpg)